Homeowners Insurance in and around Lubbock

Protect what's important from unplanned events.

Help cover your home

Would you like to create a personalized homeowners quote?

- Lubbock

- Wolfforth

- Slaton

- Plainview

- Levelland

- Amarillo

- Lamesa

- Tahoka

- Abilene

- Midland

- Odessa

- Andrews

- San Angelo

- New Deal

- Shallowater

- Pampa

- Monahans

- Hereford

- Pecos

- Big Spring

- Canyon

- Childress

- Snyder

- Brownfield

There’s No Place Like Home

When you’re tired from another long day, there’s nothing better than coming home. Home is where you laugh and play, wind down and take it easy. It’s where you build a life with family and friends.

Protect what's important from unplanned events.

Help cover your home

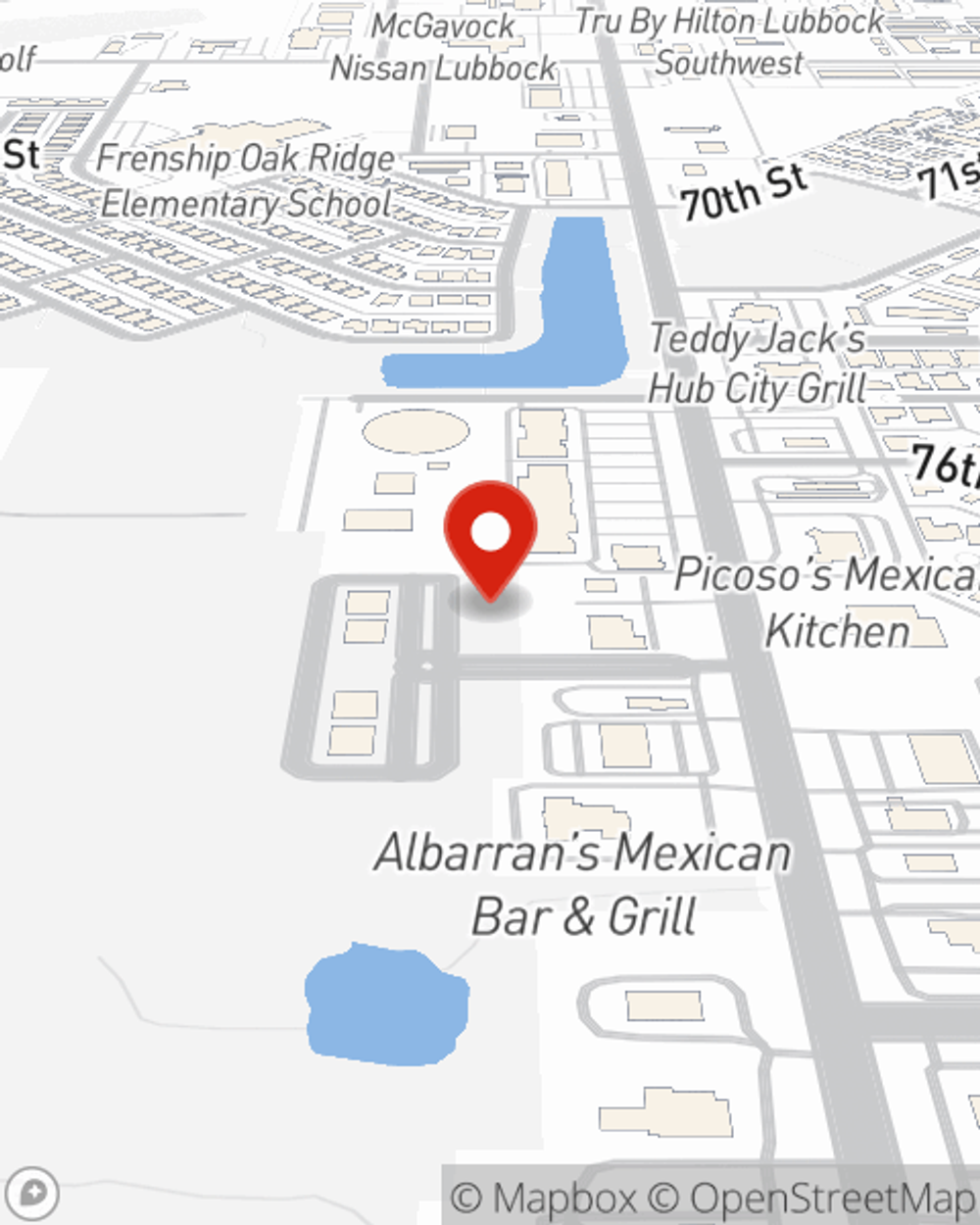

Agent Evan Brown, At Your Service

Your home is the cornerstone for the life you treasure. That’s why you need State Farm homeowners insurance, just in case the unexpected happens. Agent Evan Brown can roll out the welcome mat to help provide you with coverage for your particular situation. You’ll feel right at home with Agent Evan Brown, with a hassle-free experience to get dependable coverage for your homeowner insurance needs. Personalized care and service like this is what sets State Farm apart from the rest. Home can be a sweet place to live with State Farm homeowners insurance.

It's always the right move to cover your home with State Farm. Then, you won't have to worry about the unexpected blizzard damage to your property. Contact Evan Brown today to learn more about your options or ask how to bundle and save!

Have More Questions About Homeowners Insurance?

Call Evan at (806) 793-2858 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.

Backyard playground and trampoline safety tips

Backyard playground and trampoline safety tips

These outdoor playground and backyard trampoline safety tips can help keep everyone safe. Don’t take unnecessary risks.

Simple Insights®

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.

Backyard playground and trampoline safety tips

Backyard playground and trampoline safety tips

These outdoor playground and backyard trampoline safety tips can help keep everyone safe. Don’t take unnecessary risks.